Nashville, Tennessee-based Hospital Corporation of America (HCA) (NYSE: HCA), a for-profit operator of health care facilities and largest such operator in the world, announced that it has leased a new, state-of-the-art, medical buildings at Lake Whitney Medical and Professional Park, located at 291 NW Peacock Blvd. in Port St. Lucie West, within Lake Whitney Medical and Professional Campus.

Nashville, Tennessee-based Hospital Corporation of America (HCA) (NYSE: HCA), a for-profit operator of health care facilities and largest such operator in the world, announced that it has leased a new, state-of-the-art, medical buildings at Lake Whitney Medical and Professional Park, located at 291 NW Peacock Blvd. in Port St. Lucie West, within Lake Whitney Medical and Professional Campus.

The Campus is situated on over 15 lake-front acres in the heart of St. Lucie West’s retail, restaurant and entertainment district. The new location will help HCA service its clients in St. Lucie County. The 22,700-square-foot space will be split between primary care doctors and specialty services such as OB-GYN and cosmetic surgery.

Tom Robertson

Tom Robertson, principal of CRE Florida Partners and Rauch, Lupo, Robertson & Co., represented the landlord in the deal. J. Forbes, CCIM with Barron and Associates represented HCA.

Brookdale Corp. (NYSE: BKD), also leased 11,351 square feet at Lake Whitney Medical and Professional Park, representing an expansion of its facilities. Brookdale Corp., which merged with “Nurse On Call,” provides home healthcare solutions through skilled nursing and rehabilitation. Brookdale Corp., with nearly 50,000 associates and more than 600 retirement communities, is the largest owner and operator of senior living communities throughout the United States.

Robertson represented the landlord while Brian Lightle with LBR Inc. represented the tenant in the deal.

Robertson commented, “We see a trend of national companies returning to St. Lucie County, especially with the appeal of Lake Whitney Office/Medical Park in the St. Lucie West market.”

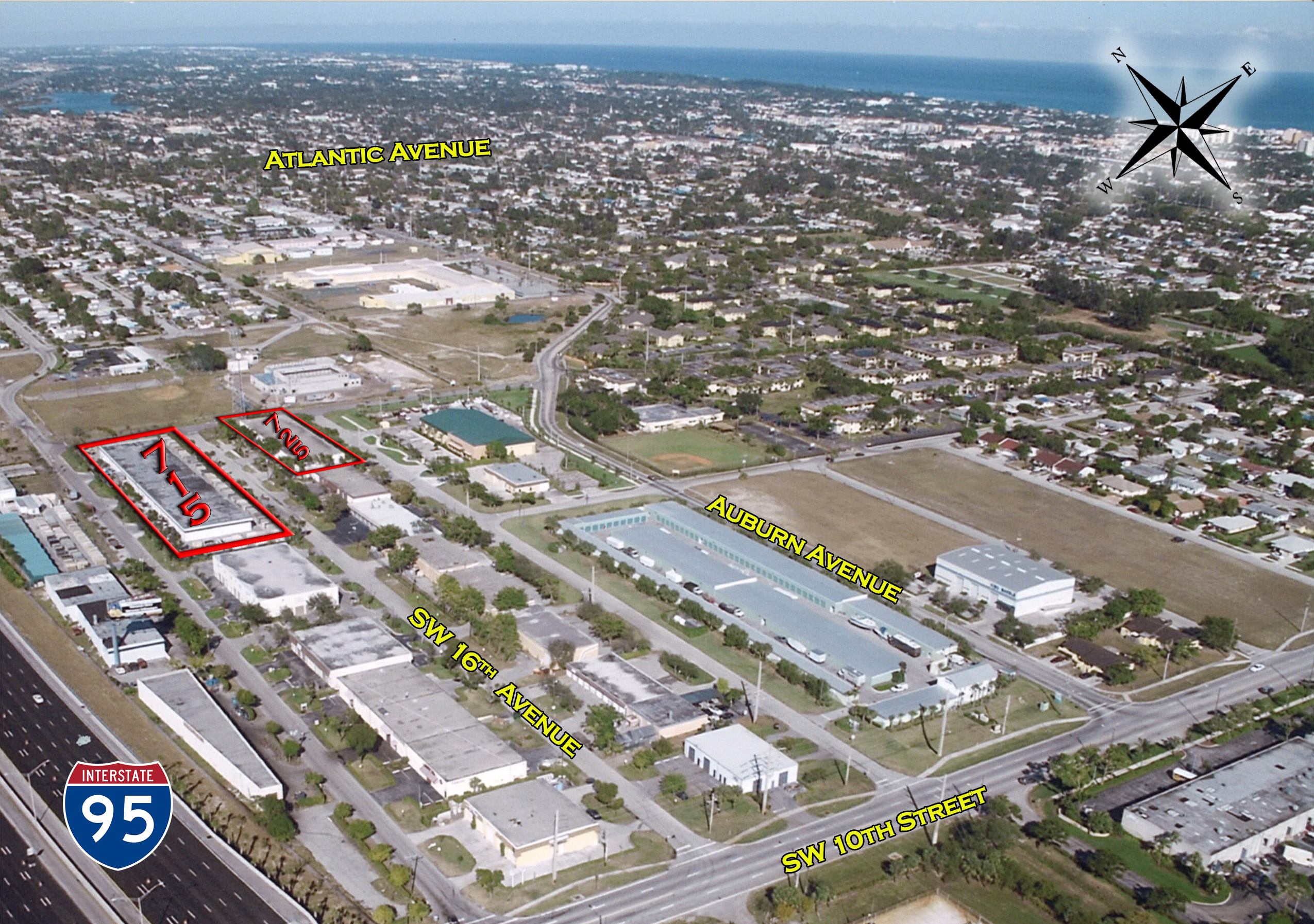

The 20-acre, 165,000-square-foot medical office campus offers ideal live/work amenities including superb highway access, retail amenities within walking distance and luxurious residential communities coupled with top quality office space.

The campus’ two newest buildings front Peacock Blvd and are just minutes from Exit #121 on I-95, near the NY Mets Training Facility. The two new buildings are currently under construction and should be operational in January 2016.

Michael Rauch, President of Rauch, Lupo Robertson & Co. and CRE Florida Partners commented, “These two new lease transactions represent a significant commitment for both HCA and Nurse on Call and clearly demonstrates the confidence that these and other companies are making in the medical industry in an improving local market.”

Robertson has been representing the Lake Whitney property since 2006.