When the effort in Congress to pass a health-care bill failed – the American Health Care Act, designed to replace the much maligned Affordable Care Act – the thing that wasn’t supposed to happen happened: The industry that had whined for years about this, that, and the other in the Obamacare law, breathed a huge sigh of relief.

Despite the general unease in the stock market, heath care stocks rallied. Well, they didn’t exactly rally, they edged up. But it made them the best-performing sector among the 11 S&P 500 sectors. But no one apparently breathed a bigger sigh of relief than the over-indebted and teetering Commercial Real Estate sector. Investors, including the largest asset managers in the world, had experienced the rich benefits of a multi-year mega construction boom of hospitals, medical office buildings, and other health-care facilities to accommodate the ballooning industry that is taking over the US economy and provides 16% of its private-sector jobs.

Property prices had soared over the years as part of the overall commercial real estate bubble. It has gotten so huge that if it deflates, it risks taking down the banks, particularly smaller banks where CRE lending is heavily concentrated. Even Federal Reserve governors admit its policies since the Financial Crisis have helped fuel this bubble, and it admits that it is a bubble, and references to it keep showing up in their statements and speeches as the fretting has begun. Among them, Boston Fed President Eric Rosengren, a Fed “dove,” is now worried that the commercial real-estate bubble in the US has once again become a risk to “Financial Stability.”

Just how relieved are commercial real estate investors really?

Chris Muoio, Senior Quantitative Strategist, Ten-X Research, of online CRE platform Ten-X, put it this way on Monday: “We noted at the beginning of the year that the new presidential administration in D.C. potentially increased risks for certain commercial real estate sectors as proposed regulatory and legislative changes could alter the growth trajectory of industries and with that the demand for certain types of commercial real estate. One of the sector’s that faced the most acute possible changes was medical office/retail as the new administration proposed sweeping changes to health care legislation. Hospitals and medical offices faced the prospect of lower demand for health care services as the proposed legislation would have reduced the number of insured patients and the growth pace of federal spending on health care.”

Which sums up what the sector has been expecting year-in and year-out: endless growth in revenues, paid for by government entities, insurers, and the flow of premiums. Throw doubt on these endless growth stories, and health-care focused real estate quakes in its foundations.

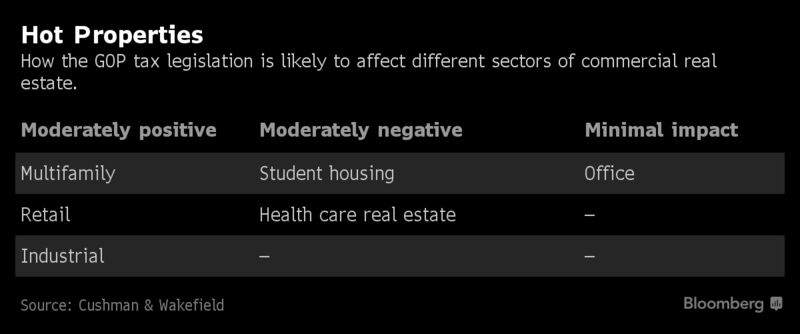

The note goes on: “Following the withdrawal of the proposed American Health Care Act, real estate investors in the medical and health care space can breathe easier as it appears this risk has dissipated. The proposed legislation was scuttled late last week as it became clear it lacked the votes to pass the House. The current rhetoric out of Washington signals a desire to move off of the issue and towards other policy initiatives. Commercial real estate investors should continue to monitor the machinations in Washington carefully, as the administration could revert to the issue at a later time, but for now it appears the existing fundamental story underlying health-care based real estate, which has produced uninterrupted growth in health care services, should remain intact.”

CRE investors are among the biggest beneficiaries of the health care monster that has been draining consumers, businesses, and governments for years, starting way before Obamacare was even a word. And for as long, this health care monster has been cannibalizing other sectors of consumer, business, and government spending.

So it makes sense that commercial real estate investors, at the peak of this bubble, are dreading any little thing that might possibly derail that gravy train. Booms and busts have historically been driven by speculation and over-borrowing, often triggering recessions. This time, the health care sector, after years “of unsustainable growth,” has become the biggest “systemic recession risk” to the US economy, as the debt binge that funded it, hits its limit.

Source: The Real Deal